Accounting system for SMEs is necessary regardless of the industry, in order to track and manage financial transactions. Some of the key reasons why an accounting system is necessary...

Capital Gains Tax (CGT) was reintroduced in Kenya through the Finance Act 2014, amending the 8th Schedule of the Income Tax Act Cap 470. CGT applies to the sale...

Fraud is often associated with external intruders or sophisticated hackers. However, a significant threat to any business might be sitting quietly in a cubicle. Long-serving employees, in particular, can...

Internal controls audit improves operational efficiency for SMEs. The collapse of the cryptocurrency exchange FTX in November serves as a stark reminder of what can happen when a corporation...

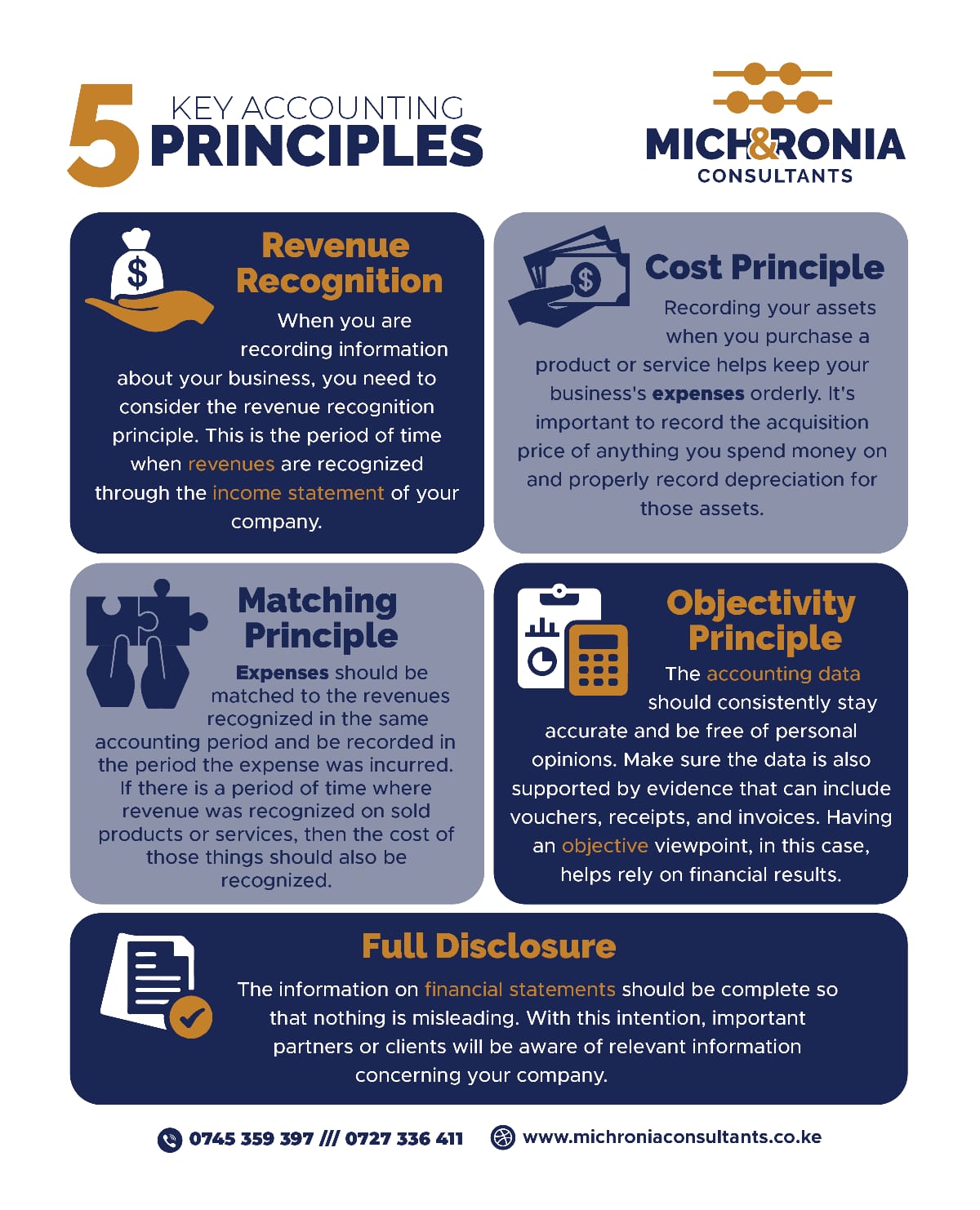

Accounting principles are essential guidelines governing the preparation and reporting of a company’s financial statements. These principles ensure consistency, reliability, and transparency, making it easier for stakeholders to understand...

Outsourcing Accounting Services in Kenya Outsourcing accounting services in Kenya has become a strategic move for many businesses, offering numerous advantages over maintaining an in-house accounting team. Whether you’re...

Starting a business in Kenya is an exciting venture, but it comes with its own set of challenges. Whether you’re launching a small retail shop, a tech startup, or...

Adding Directors to Your Kenyan Company The growth and success of any Kenyan company hinge on strong leadership. As your business evolves, you may reach a point where adding...

Removal of a director from a Kenyan company is often a sensitive and complex matter. However, with the right understanding of the legal procedures, the process can be managed...

Outsourced Accounting services in Kenya The Kenyan business landscape is experiencing a surge in the adoption of outsourced accounting services. This trend signifies a shift towards a more strategic...