Accounting principles are essential guidelines governing the preparation and reporting of a company’s financial statements. These principles ensure consistency, reliability, and transparency, making it easier for stakeholders to understand and compare financial information. Here’s how to apply accounting principles in the financial preparation of a company:

Adherence to GAAP or IFRS:

GAAP and IFRS are the main accounting frameworks globally. A company should choose one based on regulatory requirements and industry standards. Ensure all financial statements follow the chosen framework, which provides clear rules on recording and reporting transactions.

Accrual Principle:

The accrual principle mandates recognizing revenues and expenses when earned or incurred, not when cash is received or paid. Record revenue when services are provided or goods delivered, and record expenses when incurred. This reflects the company’s true financial position.

Consistency Principle:

The consistency principle requires using the same accounting methods and procedures over time. Apply the same depreciation method, inventory valuation technique, or revenue recognition approach consistently. If changes occur, disclose them in the financial statements with an explanation.

Conservatism Principle:

The conservatism principle advises choosing the option that results in lower profits or asset valuations when uncertainties exist. Estimate potential losses, such as bad debts or inventory obsolescence, conservatively. This approach avoids overestimating profits or assets.

Materiality Principle:

The materiality principle states that all significant information affecting a user’s decision should be included in financial statements. Assess which transactions are material enough to report. Small, insignificant expenses can be aggregated, but large or unusual transactions must be disclosed separately.

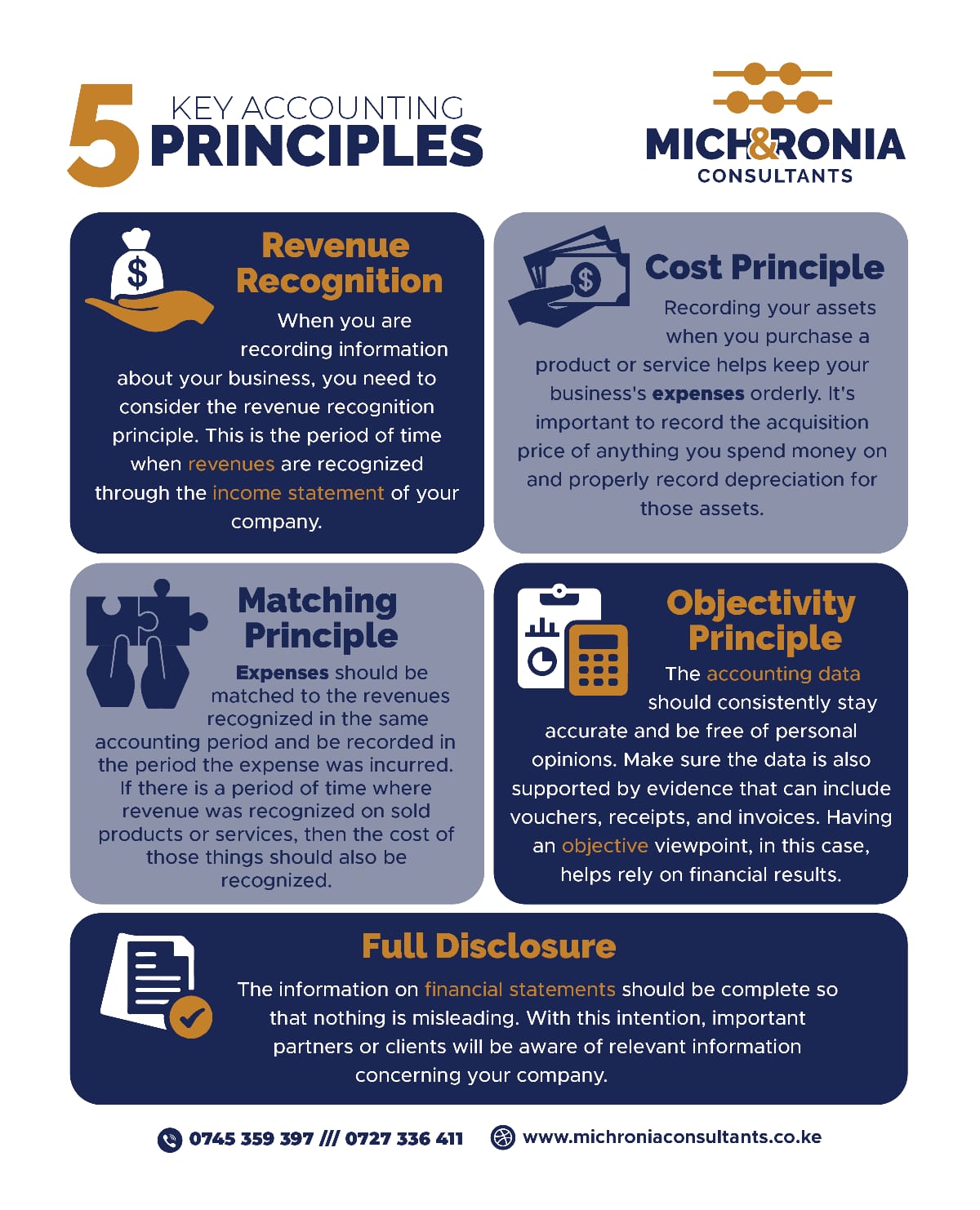

Revenue Recognition Principle:

The revenue recognition principle dictates recognizing revenue when realized and earned, not necessarily when cash is received. Ensure revenue is recognized only when the company delivers goods or services with reasonable assurance of payment. This avoids distorting financial results.

Matching Principle:

The matching principle requires matching expenses with the revenues they generate in the same accounting period. Record costs incurred to generate revenue in the same period as the revenue. For example, record the cost of goods sold in December if they generate revenue in December.

Full Disclosure Principle:

The full disclosure principle requires disclosing all relevant and necessary information for understanding a company’s financial statements. Include notes and explanations for any significant events, accounting methods, or uncertainties affecting the financial statements.

Going Concern Principle:

The going concern principle assumes the company will continue to operate in the foreseeable future. Record assets and liabilities based on this assumption. If doubts about the company’s ability to continue arise, disclose them in the financial statements.

Objectivity Principle:

The objectivity principle requires financial information to be based on verifiable evidence and free from personal bias. Ensure all financial transactions are supported by objective evidence, such as invoices and contracts, to maintain reliability.

Conclusion:

Applying accounting principles in financial preparation ensures accurate, consistent, and transparent financial statements. By following these principles, a company provides a clear and reliable picture of its financial health, crucial for stakeholders like investors, creditors, and regulators.

For advice on applying accounting principles and preparing financial statements, contact us via call/text,/WhatsApp at :0745 359397, email at info@michroniaconsultants.co.ke, or visit our website.

After preparing financials, the next step is tax computation. For assistance with all KRA matters, visit our partner’s website at taxexperts.co.ke.