Ratio analysis in Kenya

Ratio analysis is a crucial tool for businesses, financial analysts, and investors to evaluate a company’s financial health. In Kenya, understanding and applying ratio analysis can help organizations assess their performance and make informed decisions. Ratios provide insight into profitability, liquidity, solvency, and operational efficiency, helping businesses achieve better control over their financial standing.

In this detailed discussion, we’ll explore the different types of ratios, their significance, and how businesses in Kenya can use ratio analysis to improve their financial management.

What is Ratio Analysis?

Ratio analysis refers to the process of calculating and interpreting various financial ratios using a company’s financial statements. These ratios help assess aspects such as profitability, liquidity, and solvency. By comparing ratios with industry benchmarks or historical data, businesses can determine whether they are performing well or need improvements.

Ratios typically come from two main financial documents: the income statement and the balance sheet. Financial analysts calculate ratios to give insights into the company’s current performance, identify trends, and predict future outcomes. Businesses in Kenya, regardless of size, can benefit from regular ratio analysis to improve strategic decision-making and optimize resource allocation.

For professional assistance on ratio analysis, contact us at 0745 359397 or email info@michroniaconsultants.co.ke for tailored financial analysis services.

Types of Financial Ratios

In Kenya, businesses commonly use several types of financial ratios to evaluate different aspects of their operations. Below are the four main categories of financial ratios:

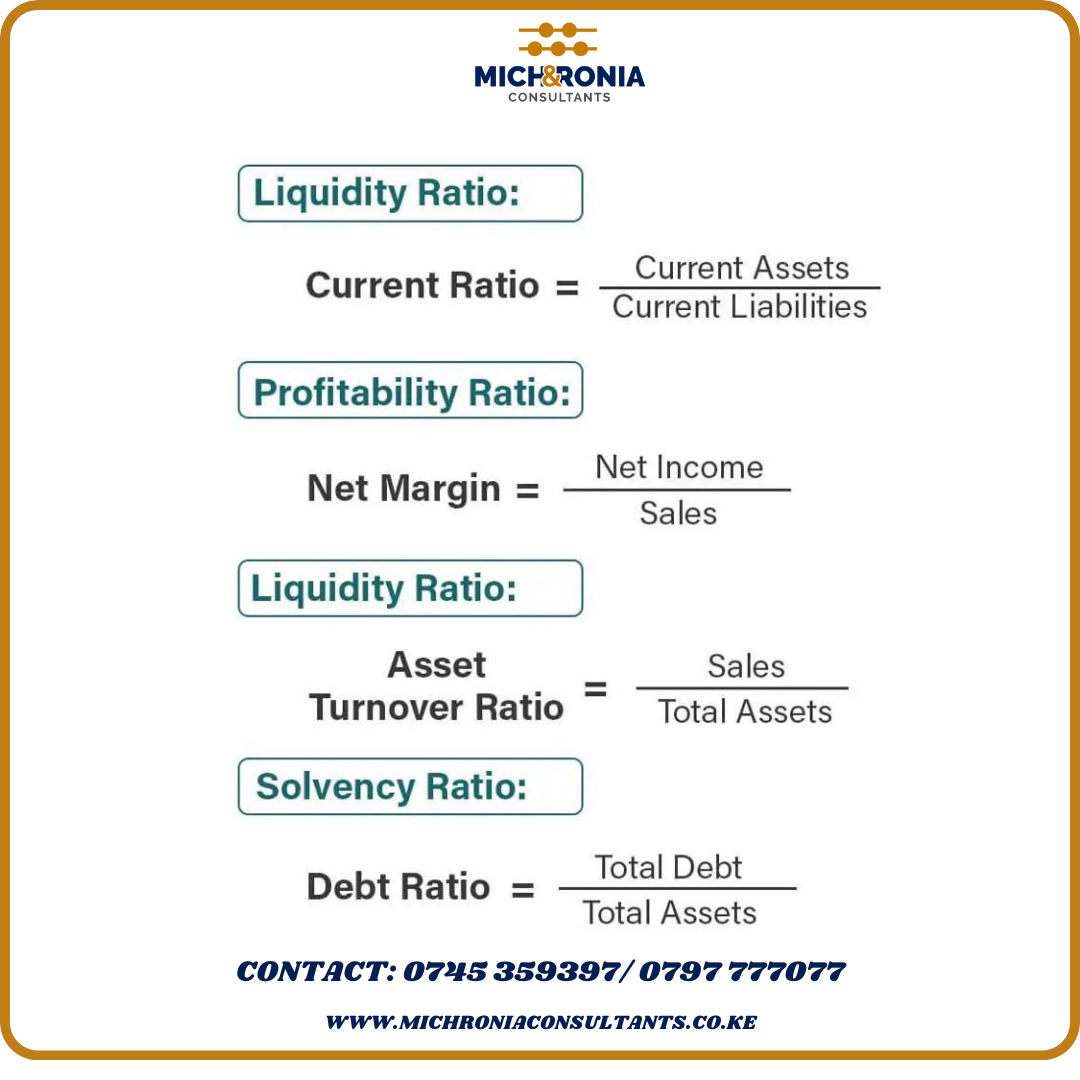

- Liquidity Ratios: These ratios measure the company’s ability to meet its short-term obligations. The most common liquidity ratios include the current ratio and quick ratio. A higher ratio indicates better liquidity, meaning the company can easily cover its liabilities.

- Profitability Ratios: Profitability ratios evaluate a company’s ability to generate income relative to its revenue, assets, or equity. Key profitability ratios include the gross profit margin, net profit margin, and return on assets (ROA). A higher profitability ratio signals better financial health.

- Solvency Ratios: These ratios assess the company’s long-term financial stability. The debt-to-equity ratio, interest coverage ratio, and equity ratio are common examples. Businesses with lower solvency ratios are considered less risky.

- Efficiency Ratios: Efficiency ratios measure how well a company utilizes its assets to generate revenue. Examples include the inventory turnover ratio and asset turnover ratio. A higher efficiency ratio indicates better use of assets.

Each of these ratios provides valuable insights into the company’s financial health, helping stakeholders make data-driven decisions.

For more information on financial ratios, reach out to us at 0745 359397 or email info@michroniaconsultants.co.ke. We provide customized ratio analysis services to help you achieve financial success.

Importance of Ratio Analysis in Kenya

Ratio analysis holds significant importance for businesses operating in Kenya. It offers a simple and effective way to interpret complex financial data, making it a valuable tool for management, investors, and creditors. Below are the key benefits of ratio analysis:

- Informed Decision-Making: Ratio analysis helps management make informed decisions about growth strategies, cost management, and investment opportunities. It provides a clear picture of the company’s financial status.

- Performance Evaluation: By comparing ratios to industry benchmarks, businesses can assess their performance relative to competitors. This comparison highlights strengths and areas for improvement, driving better operational efficiency.

- Risk Management: Ratio analysis allows businesses to identify potential risks, such as liquidity problems or excessive debt. Early detection of financial issues enables companies to take corrective actions before problems escalate.

In the Kenyan business environment, ratio analysis proves invaluable for firms aiming to remain competitive and financially sustainable.

Need professional advice on how to use ratio analysis for better decision-making? Contact us today at 0745 359397 or email info@michroniaconsultants.co.ke.

Key Financial Ratios to Watch

Certain financial ratios are more relevant to businesses in Kenya, depending on their industry and specific circumstances. Below are some of the most important financial ratios:

- Current Ratio (Liquidity): This ratio measures the ability of a company to pay its short-term liabilities with its current assets. A current ratio higher than 1 indicates that the company has sufficient assets to meet its obligations.

- Debt-to-Equity Ratio (Solvency): This ratio indicates the proportion of debt to equity in a company’s capital structure. A lower debt-to-equity ratio suggests the company relies more on its equity than debt, which is less risky.

- Return on Equity (ROE): ROE measures how effectively a company uses shareholders’ equity to generate profits. A higher ROE indicates efficient use of equity capital.

- Net Profit Margin (Profitability): This ratio shows the percentage of revenue that remains after all expenses. A high net profit margin reflects strong financial performance and cost management.

These ratios are essential for evaluating financial performance and gaining insights into a company’s strengths and weaknesses.

For expert guidance on how to calculate and interpret these ratios, contact us at 0745 359397 or email info@michroniaconsultants.co.ke. Visit our website at www.michroniaconsultants.co.ke for more resources.

Challenges of Ratio Analysis

While ratio analysis is a valuable tool, it also has limitations. Businesses in Kenya should be aware of these challenges:

- Data Quality: Ratio analysis relies heavily on the accuracy of financial statements. If the underlying data is incorrect or manipulated, the ratios will provide misleading information.

- Industry Differences: Ratios vary significantly across industries, making it difficult to compare companies from different sectors. Businesses must ensure they compare their ratios with those of competitors within the same industry for meaningful analysis.

- Short-Term Focus: Some ratios, such as liquidity ratios, only provide short-term insights and may not reflect the company’s long-term stability. Companies should use a mix of ratios for a holistic view of their financial health.

Despite these challenges, ratio analysis remains a fundamental tool for business analysis.

For solutions to the limitations of ratio analysis, reach out to Mic&hronia Consultants at 0745 359397 or email info@michroniaconsultants.co.ke.

Leveraging Ratio Analysis for Success

In conclusion, ratio analysis in Kenya is an essential tool for businesses looking to assess their financial performance. By focusing on liquidity, profitability, solvency, and efficiency ratios, companies can gain valuable insights into their operations, identify risks, and make data-driven decisions. Ratio analysis offers a straightforward method to evaluate financial health, making it a valuable resource for management, investors, and creditors alike.

At Mich&ronia Consultants, we offer comprehensive ratio analysis services tailored to meet the unique needs of businesses in Kenya. Our expert team can help you calculate, interpret, and use financial ratios to improve decision-making, risk management, and performance evaluation.

Contact us today at 0745 359397 or email info@michroniaconsultants.co.ke for professional ratio analysis services that drive business success. Visit www.michroniaconsultants.co.ke for more information on our services.