Estate and inheritance tax planning in Kenya is essential for safeguarding your assets and ensuring a smooth transfer to your beneficiaries. Proper planning not only minimizes the tax burden...

Taxation is an integral part of any country’s economy, and Kenya is no exception. The Kenyan government relies heavily on taxes to finance its budget, provide public services, and...

Register a Business in Kenya as a Foreigner: A Step-by-Step Guide Kenya offers immense opportunities for foreign investors looking to start a business. Understanding the registration process is crucial...

The Principle of Least Privilege (POLP) POLP states that individuals or systems should only have the minimum access needed to perform their tasks. This limits the risk of unauthorized...

Accounting system for SMEs is necessary regardless of the industry, in order to track and manage financial transactions. Some of the key reasons why an accounting system is necessary...

Capital Gains Tax (CGT) was reintroduced in Kenya through the Finance Act 2014, amending the 8th Schedule of the Income Tax Act Cap 470. CGT applies to the sale...

Fraud is often associated with external intruders or sophisticated hackers. However, a significant threat to any business might be sitting quietly in a cubicle. Long-serving employees, in particular, can...

Internal controls audit improves operational efficiency for SMEs. The collapse of the cryptocurrency exchange FTX in November serves as a stark reminder of what can happen when a corporation...

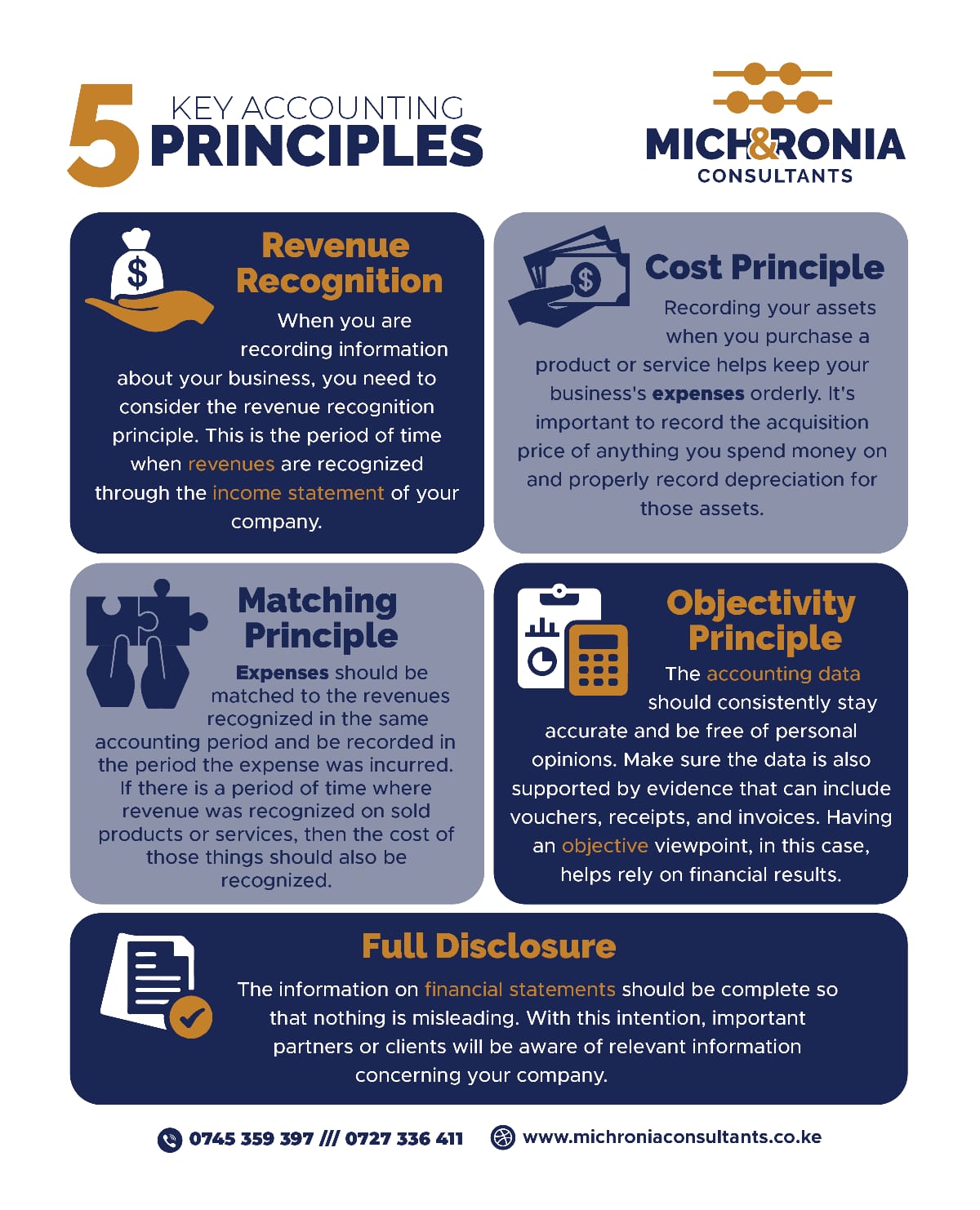

Accounting principles are essential guidelines governing the preparation and reporting of a company’s financial statements. These principles ensure consistency, reliability, and transparency, making it easier for stakeholders to understand...

Outsourcing Accounting Services in Kenya Outsourcing accounting services in Kenya has become a strategic move for many businesses, offering numerous advantages over maintaining an in-house accounting team. Whether you’re...